FreeGSTBill Panel Tour

Discover how FreeGSTBill simplifies GST & non-GST billing for small and medium Indian businesses. Our intuitive dashboard allows you to manage everything from sales, quotations, and purchases to inventory, customers, and payment tracking — all in one place.

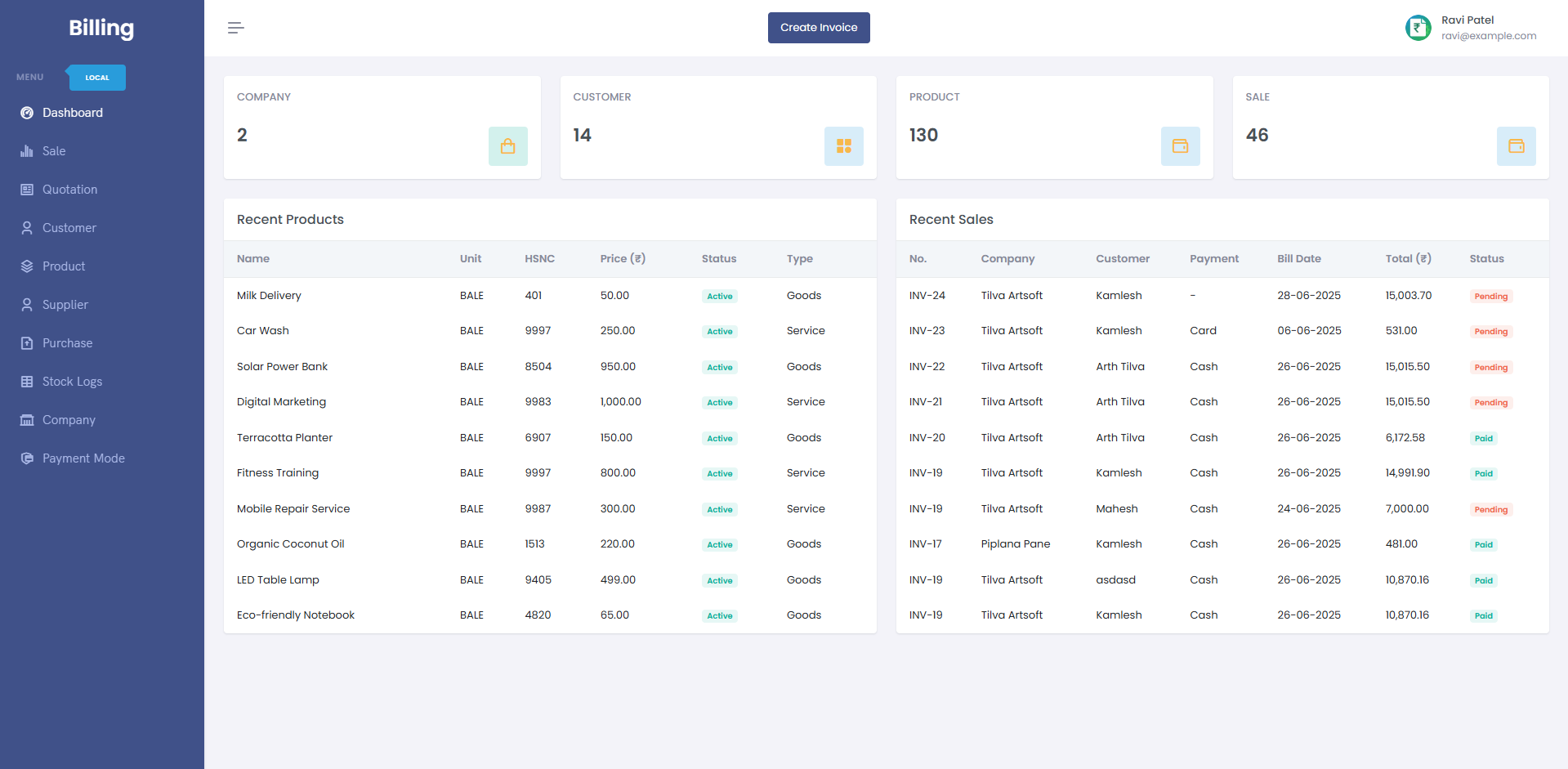

📊 Dashboard Overview

The dashboard gives you a quick glance at key business metrics: number of invoices created, pending payments, recent quotations, and company-wide sales performance. This visual summary helps business owners make fast, informed decisions.

It also highlights your active company, stock alerts, and recent customer activity to keep you informed in real time.

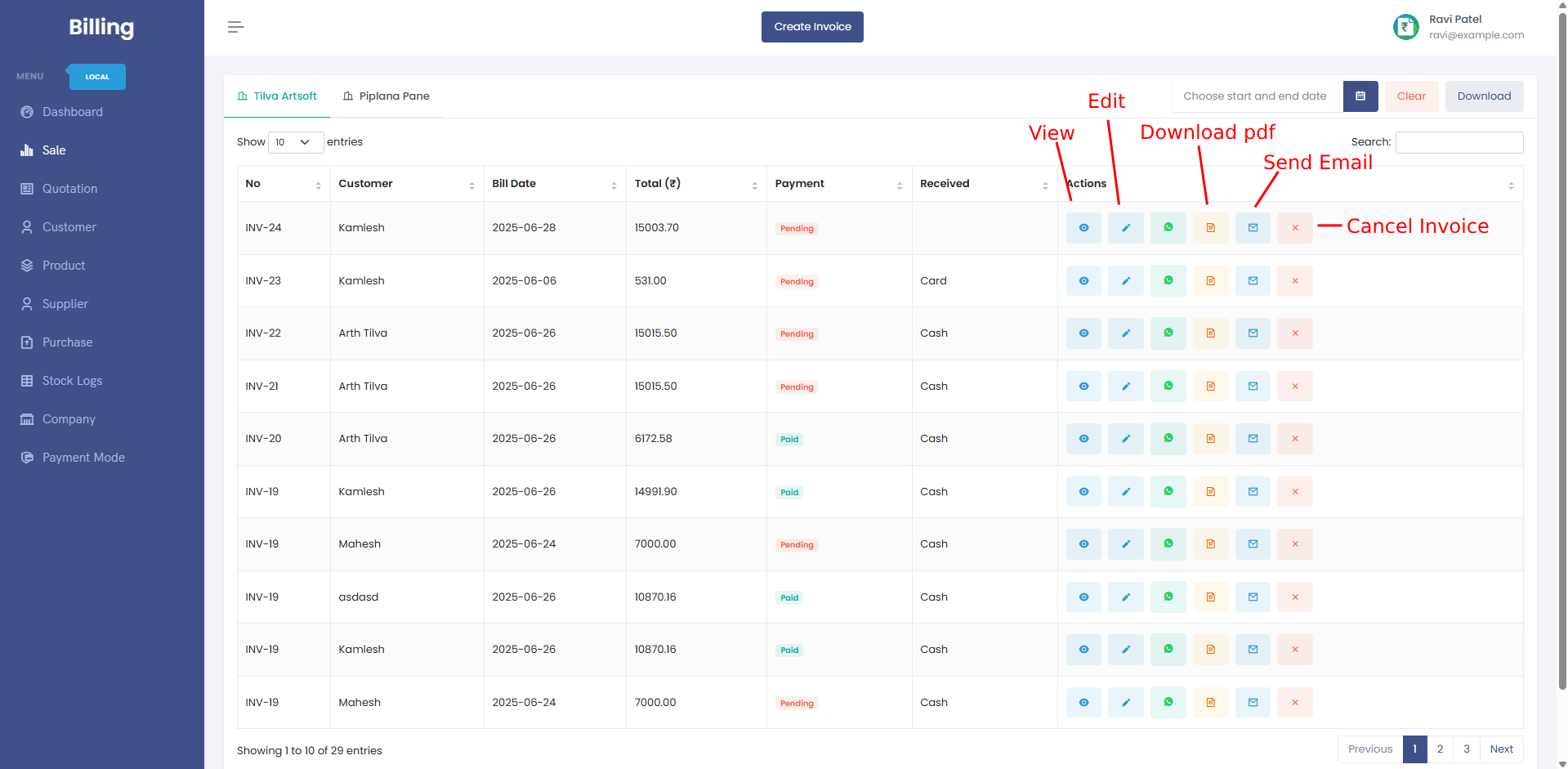

🧾 Sales (Invoices)

Create GST or non-GST invoices in just a few clicks. With prefilled customer and product data, auto tax calculation, and real-time PDF generation, invoicing becomes a breeze. You can also email or download invoices instantly.

Track status of every invoice — paid, unpaid, partially paid — and apply discounts, round-offs, or shipping charges with ease.

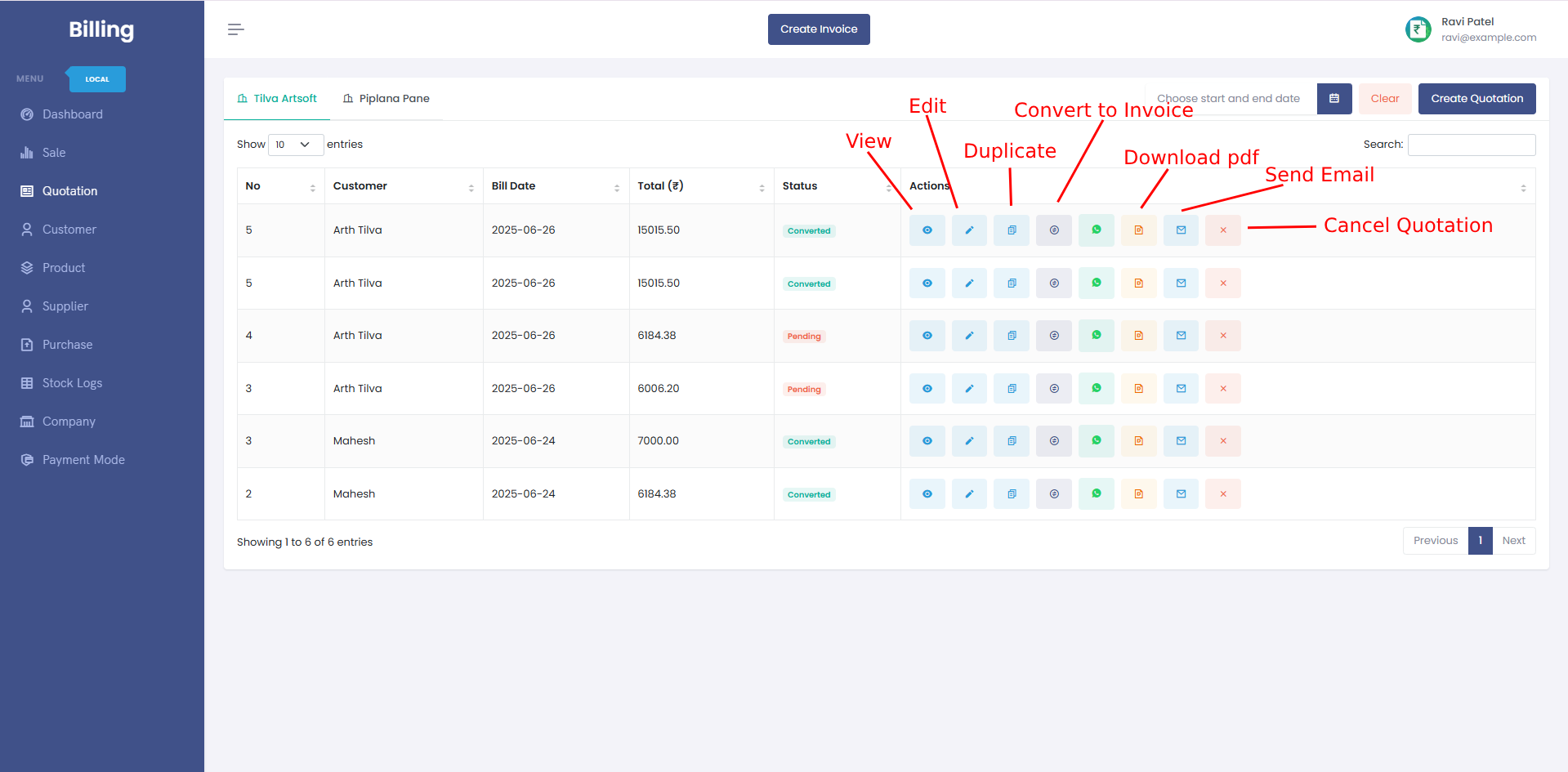

💼 Quotations

Send professional-looking quotations to potential clients. You can duplicate quotations, revise them, or instantly convert them into invoices once approved. Share via email or WhatsApp without any extra tools.

This module is perfect for businesses that deal with project pricing or negotiation-based selling.

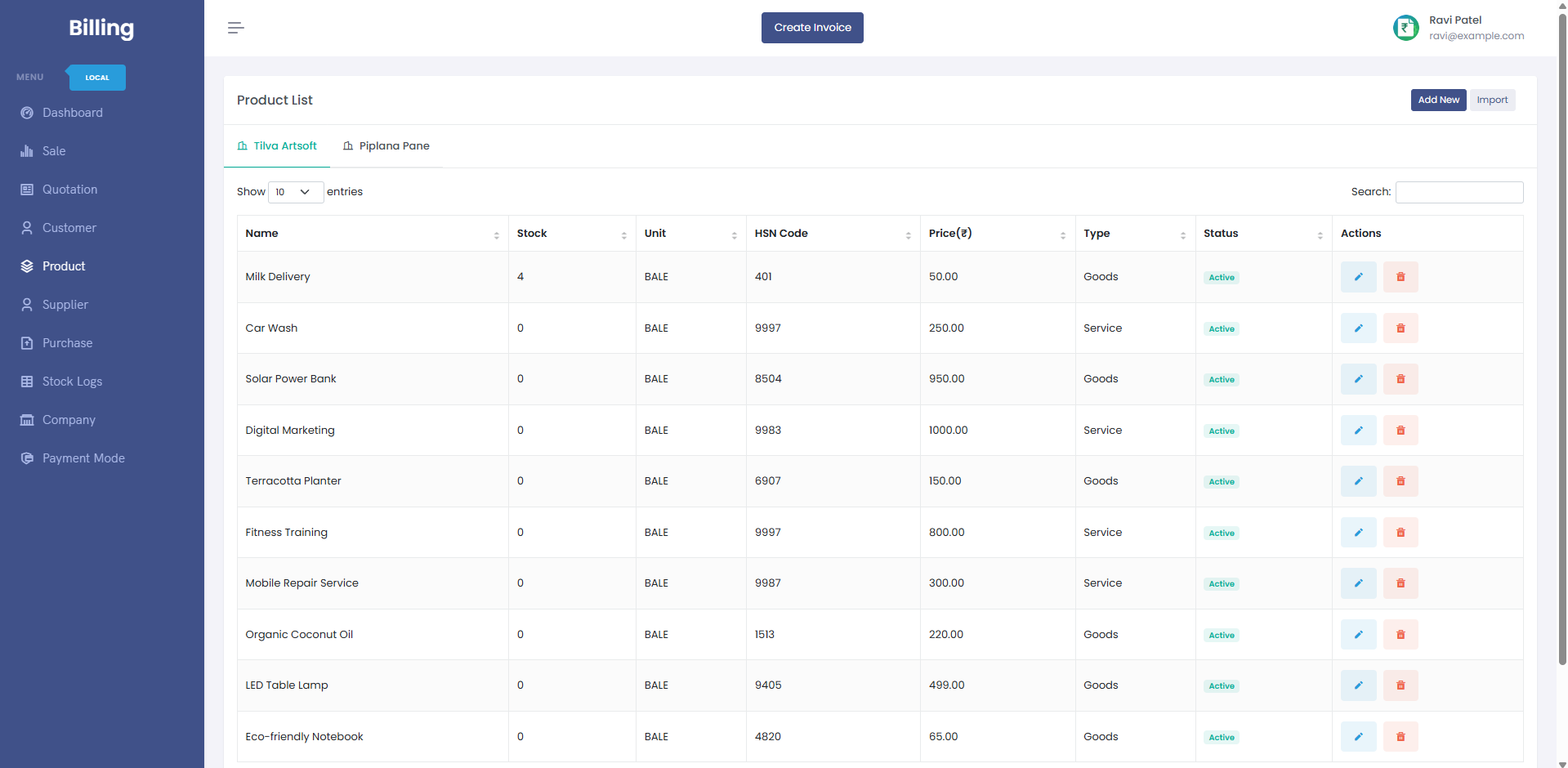

📦 Products & Services

Maintain your product or service catalog with HSN/SAC codes, pricing, and stock quantity. Reuse the products while invoicing or quoting to save time. Each product is tied to a specific company, supporting multi-company setups.

You can even assign default GST rates and unit types per item.

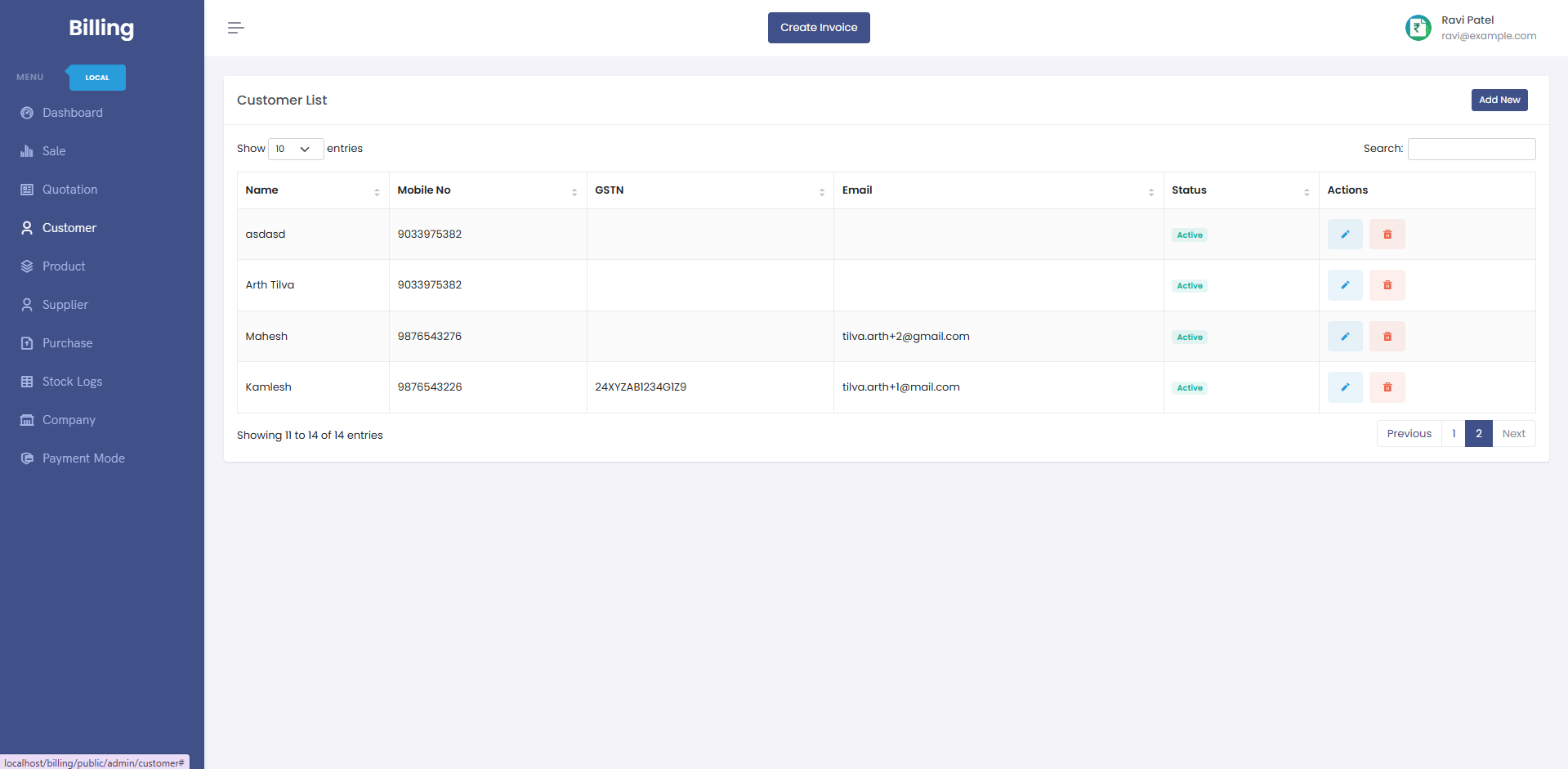

👥 Customers

Store all customer details such as billing address, GSTIN, contact information, and credit terms. This saves time during invoice generation and enables faster filtering of past transactions.

Useful for repeat clients or high-frequency billing workflows.

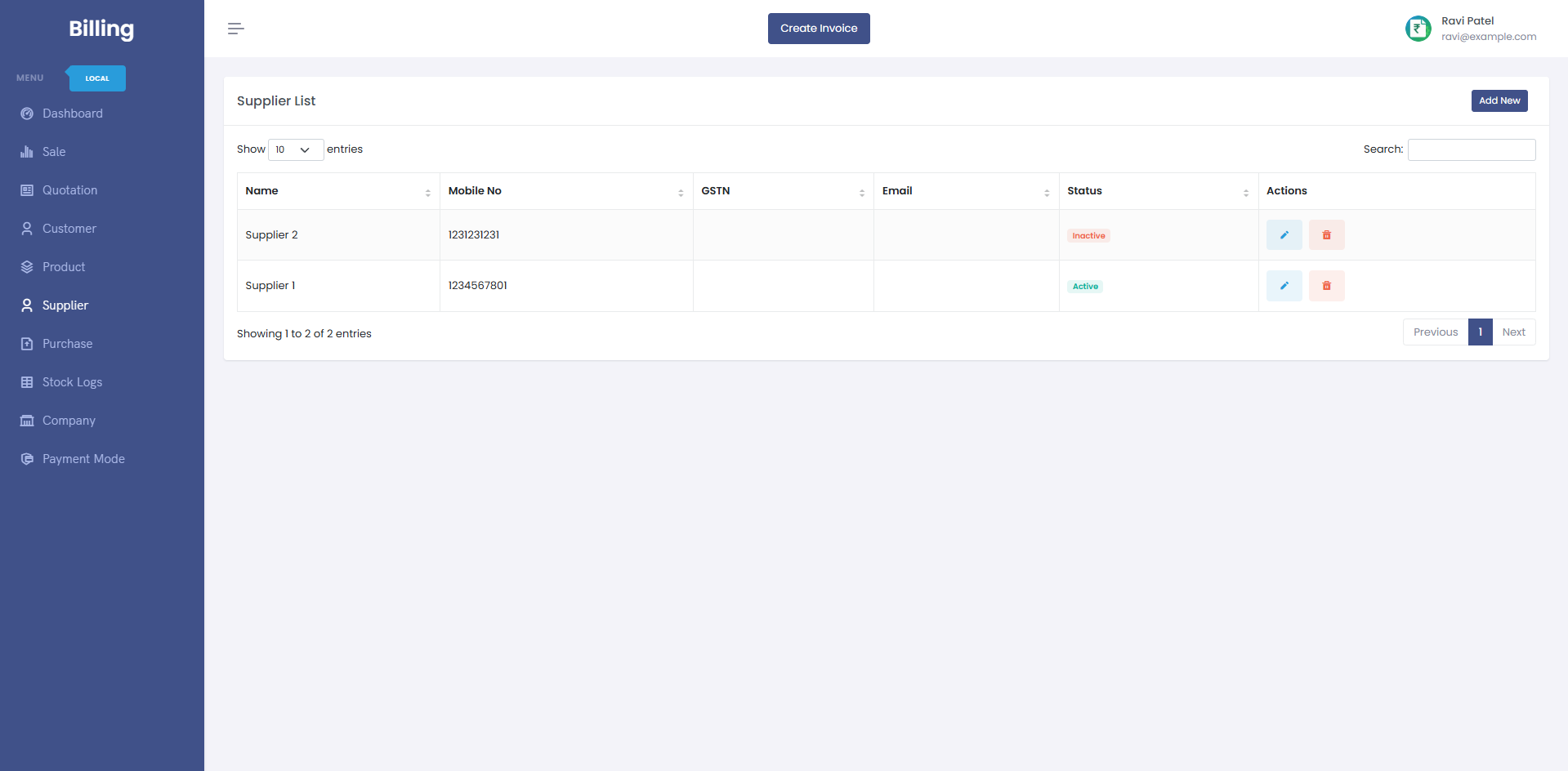

🏢 Suppliers

Keep track of your vendors for purchases. Save supplier GSTIN, contact info, and preferred payment mode. Helpful when reconciling purchase data and preparing GST returns.

Suppliers are linked with your purchase entries for complete traceability.

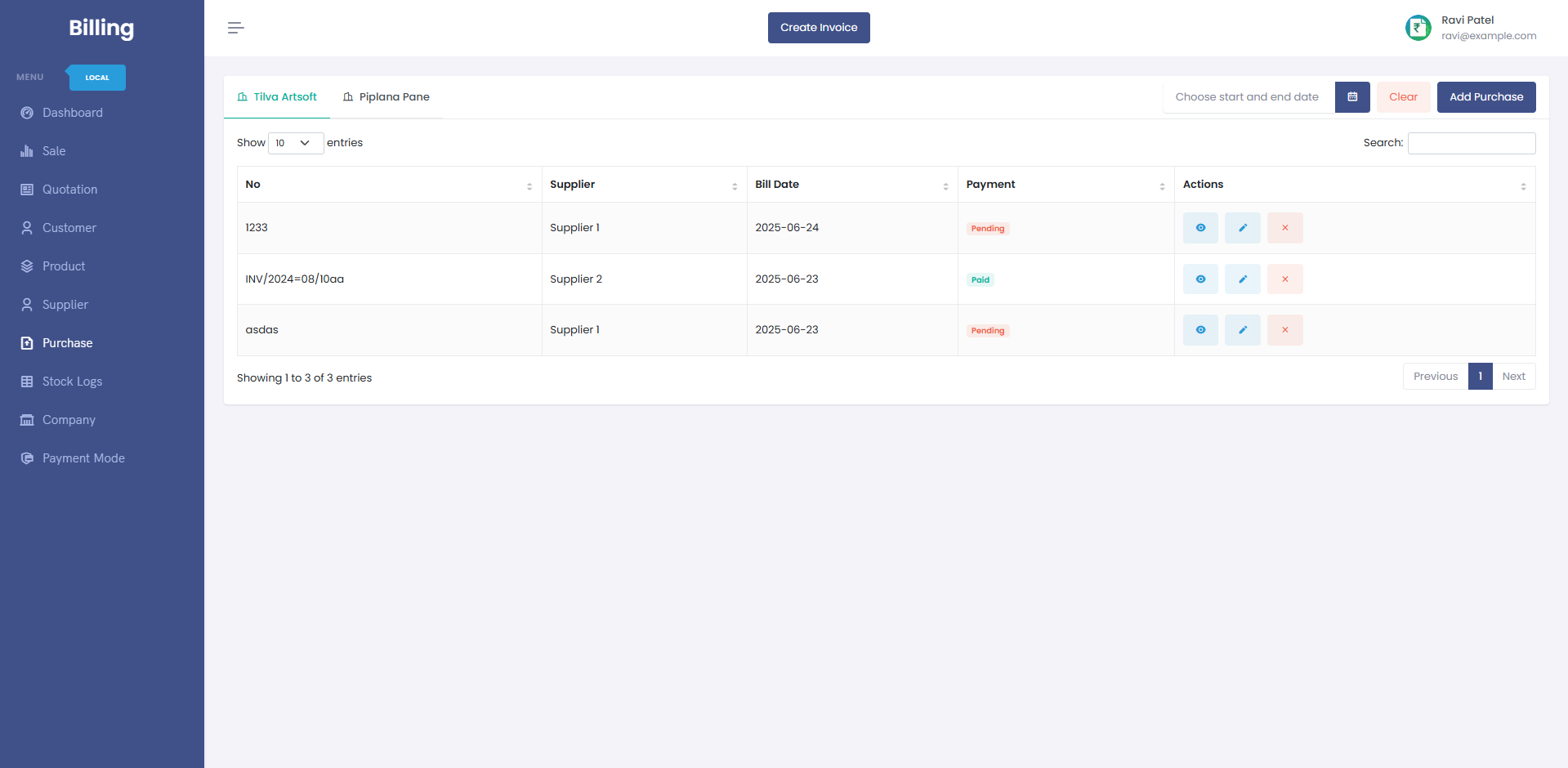

📥 Purchase Entries

Record purchases from suppliers to maintain accurate stock and input tax credit tracking. Attach bills, link suppliers, and record payment details. Your stock automatically updates when a purchase is added.

This ensures you maintain accurate inventory levels and GST compliance.

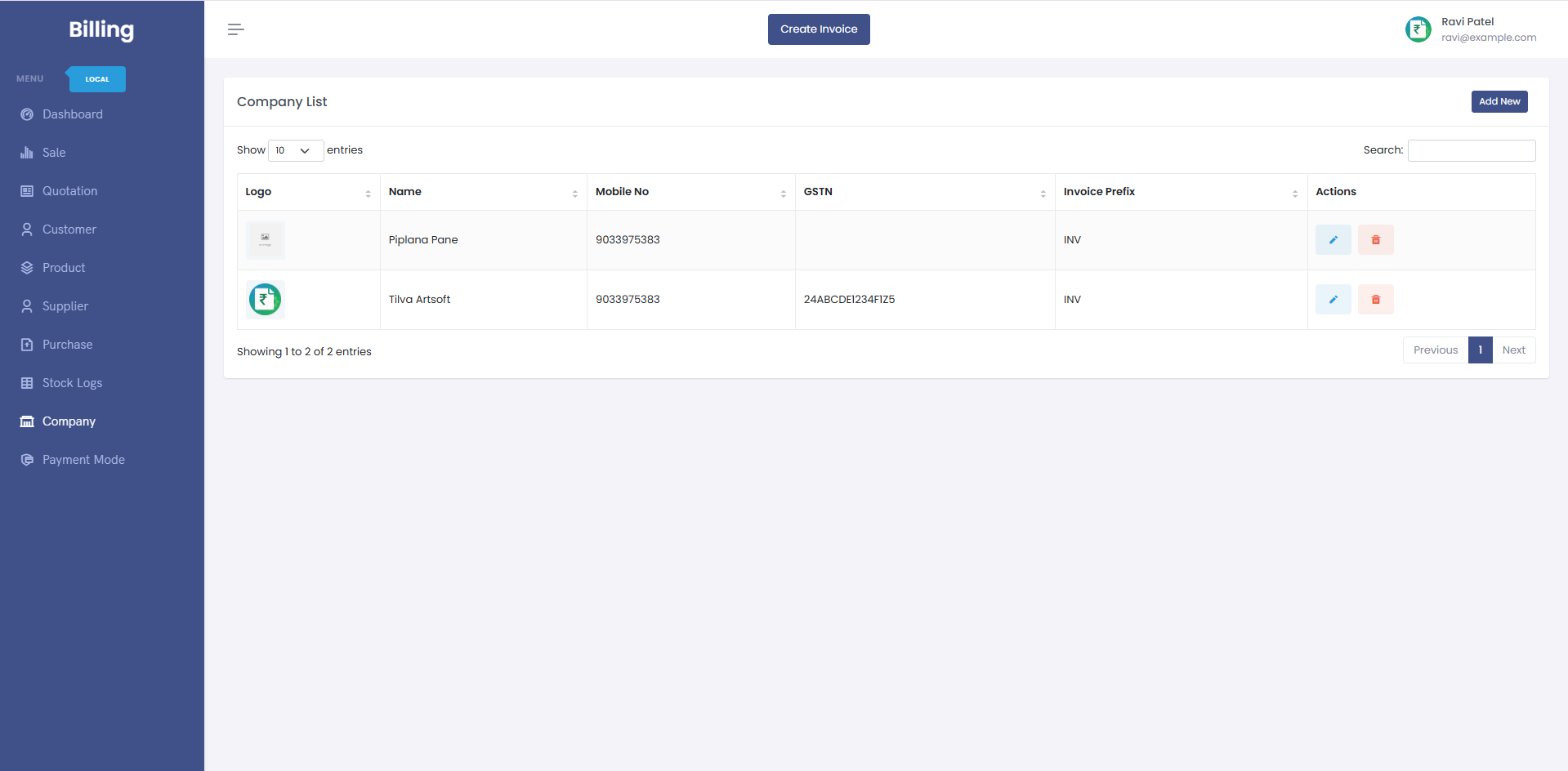

🏬 Company Settings

Add and manage multiple companies under one account. Each company can have its own GSTIN, address, logo, and invoice format. Ideal for agencies or individuals managing multiple business entities.

You can switch companies with a single click from the top menu.

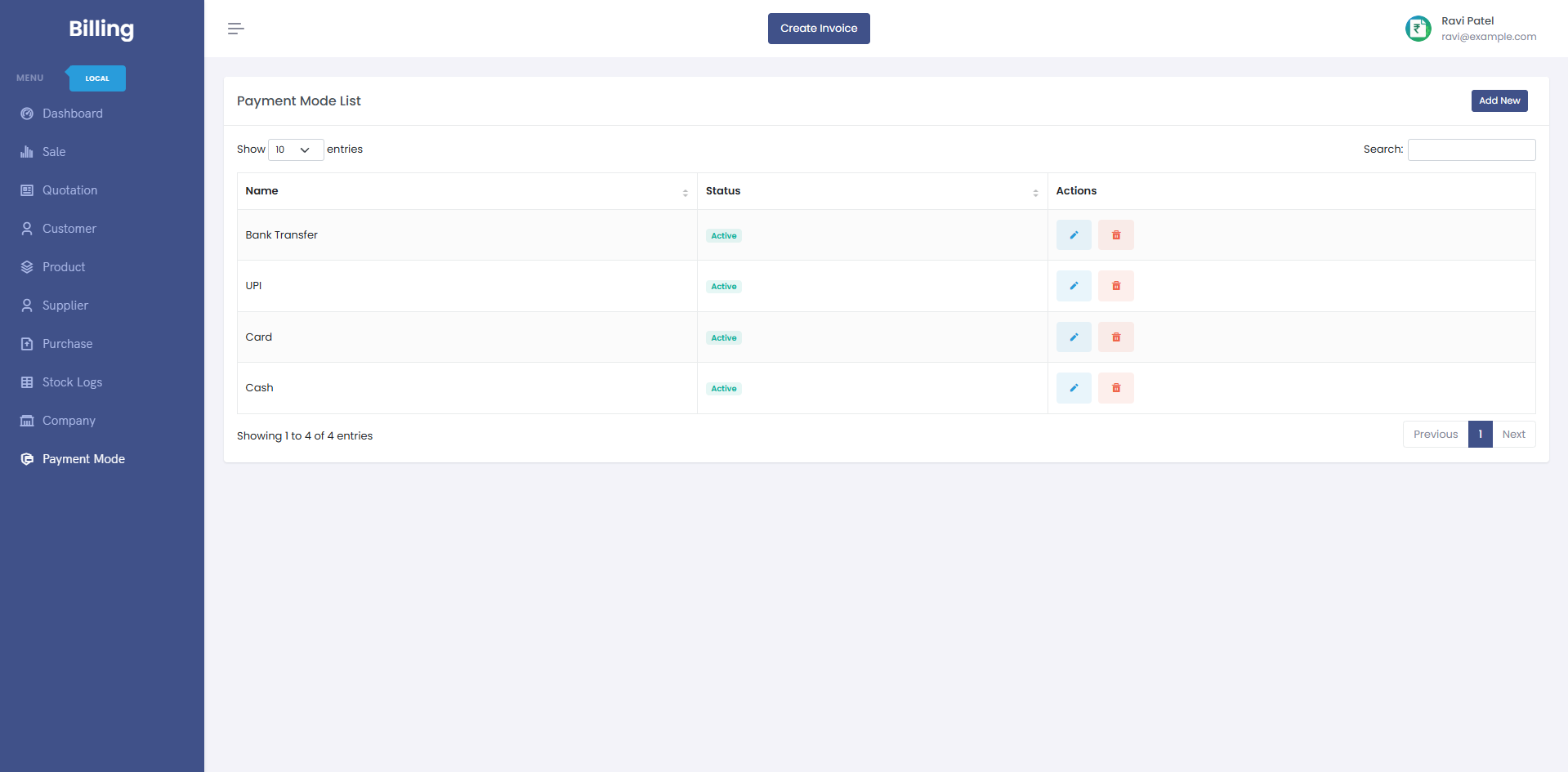

💳 Payment Modes

Add UPI, Bank Transfer, Cash, Card, Cheque or any other payment method used in your business. Each invoice or purchase can be linked to a payment method for accurate tracking and reporting.

This also makes it easier for your clients to see how they paid previously.

Ready to create account and start billing for free?

Continue on Web Browseralso download the FreeGSTBill mobile app for Android and iOS to create invoices, send quotations, or check stock even when you’re on the go.